Multiple Choice

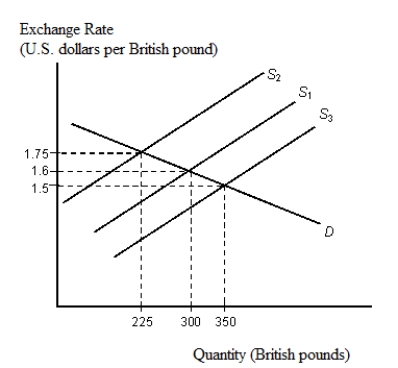

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.

Figure 21.2

-Refer to Figure 21.2. Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3. According to the Bretton Woods agreement:

A) the pound should be devalued.

B) the dollar should be devalued.

C) the British central bank should buy pounds in exchange for dollars.

D) the British central bank should encourage speculation.

E) the Fed should intervene to maintain the exchange rate of £1 = $1.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The figure given below depicts the foreign

Q8: The figure given below depicts the foreign

Q13: The figure below shows the demand (D)

Q18: The figure given below depicts the foreign

Q46: The figure given below depicts the foreign

Q64: The supply of Thai baht in the

Q79: The figure below shows the demand (D)

Q89: The figure given below depicts the demand

Q98: The figure below shows the demand (D)

Q120: The figure below shows the demand (D)