Multiple Choice

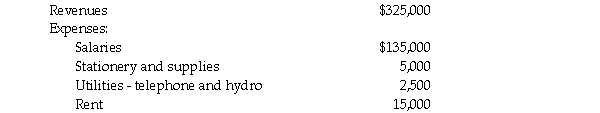

You are performing a review of a lawyer's books of account. The lawyer's office is in Ontario where the HST rate is 13 percent. While you are in her office, she asks you to calculate how much her HST remittance should be. You are given the following amounts which exclude HST charged or paid.  Based on the above transactions, the HST payable is:

Based on the above transactions, the HST payable is:

A) $21,775.

B) $39,325.

C) $39,975.

D) $41,275.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: The GST rebate on the purchase of

Q57: A registered charity in a non-participating province

Q58: For vendors of taxable supplies who purchase

Q59: How does the Canadian government compensate for

Q60: Explain the difference between an accounts-based value

Q62: Indicate two situations where the fact that

Q63: Ms. Mary Rivers works in the province

Q64: How are input tax credits calculated on

Q65: Brad Inc. had sales of merchandise during

Q66: Give two examples of entities that would