Essay

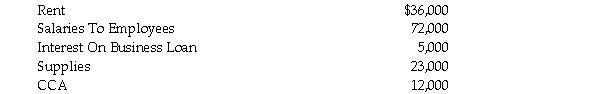

May Poplar lives in Alberta, a province that does not participate in the HST program. During the current year she records service revenue of $326,000. May has never used the ITA 34 option to record revenue on a billed basis. Her current expenses for the year are as follows (all amounts are before GST):  Her inventory of Supplies increased by $4,000 during the year. In addition to these current expenditures, she acquired additional furniture and fixtures in the amount of $18,000, before the inclusion of GST. She files her GST return on an annual basis and does not use the Quick Method.

Her inventory of Supplies increased by $4,000 during the year. In addition to these current expenditures, she acquired additional furniture and fixtures in the amount of $18,000, before the inclusion of GST. She files her GST return on an annual basis and does not use the Quick Method.

Determine the net GST payable or refund for the year.

Correct Answer:

Verified

The GST pa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: Describe the "last four calendar quarters" test

Q72: Despite several advantages of transaction taxes, such

Q73: Marvin Gardens starts a new business on

Q74: A person with taxable sales of less

Q75: If a non-registrant has taxable supplies in

Q77: Associated persons file separate GST/HST returns, but

Q78: A new car is purchased with a

Q79: A GST rebate is available to employees

Q80: The disposal of a complete business through

Q81: What is the basic problem with a