Essay

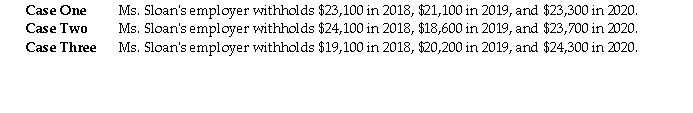

For the three years ending December 31, 2020, Gloria Sloan had combined federal and provincial Tax Payable as follows:  Using this information consider the following three independent cases.

Using this information consider the following three independent cases.  Required:

Required:

A. For each of the three cases:

• indicate whether instalments are required for the 2020 taxation year. Show all of the calculations required to make this decision;

• in those cases where instalments are required, indicate the amount of the instalments that would be required under the approach used in the CRA's instalment reminder; and

• in those cases where you have calculated the instalments required under the CRA's instalment reminder, indicate whether you believe there is a better approach and calculate the required instalments under that approach.

B. For those Cases where instalments are required, indicate the dates on which the payments will be due.

Correct Answer:

Verified

While there are alternatives in all Case...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: All of the following people will have

Q52: Larry Short has self-employment income of $62,000

Q53: Tax avoidance involves deliberately ignoring a specific

Q55: Which of the following individuals did NOT

Q56: Minnie Belanger is retired. She filed her

Q58: Ms. Deveco's 2020 income tax return is

Q59: Lemar Ltd. has a December 31 year

Q60: Bunly Im is a self-employed hairdresser. Which

Q61: A Canadian public corporation had federal taxes

Q62: One of your clients has received his