Essay

The following two Cases make different assumptions with respect to the amounts of income and deductions that are available to Carl Suzak, a Canadian resident, for the current year.

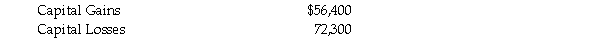

Case A - Carl had employment income of $126,100, as well as income from an unincorporated business of $14,100. A rental property owned by Carl experienced a net loss of $4,600. Dispositions of capital property during the current year had the following results:  In compliance with the terms of his divorce agreement, Carl paid deductible spousal support of $600 per month for the entire year. In addition to the preceding items, Carl had a winning lottery ticket which resulted in his receiving a prize of $562,000.

In compliance with the terms of his divorce agreement, Carl paid deductible spousal support of $600 per month for the entire year. In addition to the preceding items, Carl had a winning lottery ticket which resulted in his receiving a prize of $562,000.

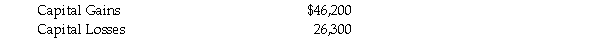

Case B - Carl had employment income of $89,000, interest income of $3,100, and net rental income of $8,600. Carl also operated an unincorporated business. Unfortunately, during the current year, it experienced a net loss of $187,400. Dispositions of capital property during the current year had the following results:  Also during the current year, Carl made deductible contributions of $8,600 to his RRSP.

Also during the current year, Carl made deductible contributions of $8,600 to his RRSP.

Required: For each Case, calculate Carl's Net Income For Tax Purposes (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the current year.

Correct Answer:

Verified

Case A

The Case A solution would be calc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The Case A solution would be calc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Any taxpayer can choose the calendar year

Q27: Indicate three disadvantages of a tax system

Q40: Under what circumstances will a person who

Q66: Which of the following statements is NOT

Q68: With respect to the residency of an

Q69: With respect to the structure of the

Q70: Which of the following could be required

Q72: Mr. John Lenonovitz is an unemployed poet.

Q75: Which of the following entities could be

Q76: Which of the following is an essential