Essay

Karla Gomez is a Canadian resident who lives in Toronto. In the following two Cases, different assumptions are made with respect to the amounts and types of income she will include in her tax return for the current year. Information is also provided on the deductions that will be available to her for the year.

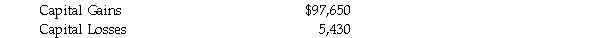

Case One - Karla had net employment income of $62,350. Unfortunately, her unincorporated flower shop suffered a net business loss of $115,600. In contrast, she had a very good year in the stock market, realizing the following gains and losses:  Also during the current year, Karla made deductible contributions of $4,560 to her RRSP.

Also during the current year, Karla made deductible contributions of $4,560 to her RRSP.

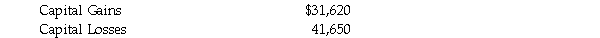

Case Two - Karla had net employment income during the year of $45,600, as well as net business income of $27,310 and a net rental loss of $4,600. As part of a divorce agreement from a previous year, Karla paid spousal support of $600 per month to her former common-law partner, Lucretia Smart for the entire year. She realized the following results in the stock market during the year:  While Karla does not gamble on a regular basis, she enjoys the ambiance of the local casino. Given this, two or three times a year, she spends an evening dining and gambling with friends there. In March of this year, she got very lucky, winning $46,000 by hitting a slot machine jackpot.

While Karla does not gamble on a regular basis, she enjoys the ambiance of the local casino. Given this, two or three times a year, she spends an evening dining and gambling with friends there. In March of this year, she got very lucky, winning $46,000 by hitting a slot machine jackpot.

Required: For each Case, calculate Karla's Net Income For Tax Purposes (Division B income)for the current year. Indicate the amount and type of any loss carry overs that would be available at the end of the year.

Correct Answer:

Verified

Case One

The Case One solution would be ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The Case One solution would be ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: The federal government does not collect personal

Q10: Which of the following would be considered

Q29: A partnership can be a taxable entity

Q34: Tax expenditures are less costly to administer

Q62: What is the meaning of "taxation year"

Q128: What are some of the factors that

Q129: Concerned with her inability to control the

Q131: Mr. Desmond Morris has spent his entire

Q136: For each of the following persons, indicate

Q137: Mrs. Janice Theil gives $50,000 in Canada