Multiple Choice

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 80% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

A) $104,000

B) $120,000

C) $130,000

D) Nil

Correct Answer:

Verified

Correct Answer:

Verified

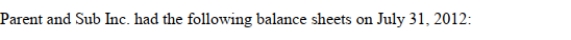

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Assume

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Assuming

Q3: When the parent forms a new subsidiary:<br>A)

Q4: Which statement about the differences between consolidation

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q8: A business combination involves a contingent consideration.

Q15: When the acquisition differential is calculated and

Q24: The purchase price of an entity includes:<br>A)

Q47: When a contingent consideration arising from a

Q53: Any negative goodwill arising on the date