Multiple Choice

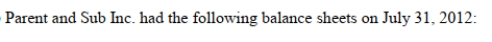

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc acquires 80% of Sub Inc on August 1, 2012, what amount would appear in the Non- Controlling Interest Account on the Consolidated Balance Sheet on the date of acquisition if the Proprietary Method were used?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc acquires 80% of Sub Inc on August 1, 2012, what amount would appear in the Non- Controlling Interest Account on the Consolidated Balance Sheet on the date of acquisition if the Proprietary Method were used?

A) Nil

B) $100,000

C) $120,000

D) $200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A negative acquisition differential:<br>A) is always equal

Q31: When a contingent consideration arising from a

Q39: A business combination involves a contingent consideration.

Q47: On the date of acquisition, consolidated shareholders'

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Assuming

Q51: The calculation of Goodwill and Non-Controlling Interest

Q51: Any goodwill on the subsidiary company's books

Q53: A company owning a majority (but less

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Assuming

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The