Multiple Choice

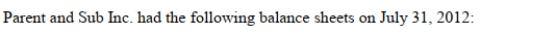

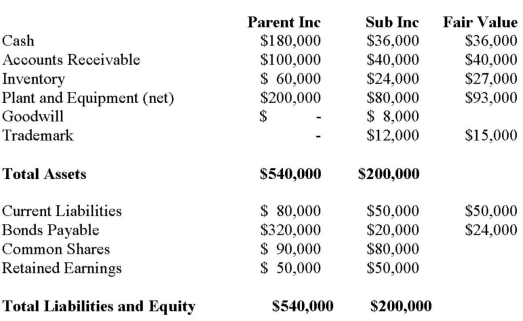

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc. purchased 80% of Sub's voting shares on the date of acquisition (August 1, 2012) for $180,000, what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc. purchased 80% of Sub's voting shares on the date of acquisition (August 1, 2012) for $180,000, what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

A) $26,000

B) $38,000

C) $45,000

D) $104,000

Correct Answer:

Verified

Correct Answer:

Verified

Q30: The focus of the Consolidated Financial Statements

Q31: If a business combination occurs and the

Q32: Non-Controlling Interest is presented in the Shareholders'

Q35: On the date of formation of a

Q38: Contingent consideration should be valued at:<br>A) the

Q38: Which accounts on the consolidated balance sheet

Q39: Discuss the disclosure requirements for long term

Q41: After the introduction of the entity method

Q46: When preparing the consolidated balance sheet on

Q55: Why might the fair value of the