Multiple Choice

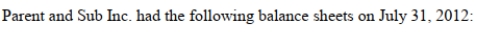

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. If Parent Company purchased 80% of Sub Inc. for $180,000, the Liabilities section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under GAAP after January 1, 2011?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. If Parent Company purchased 80% of Sub Inc. for $180,000, the Liabilities section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under GAAP after January 1, 2011?

A) $470,000

B) $474,000

C) $500,000

D) $519,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which consolidation theory should be used in

Q12: A business combination involves a contingent consideration.

Q13: IFRS permits several methods to be used

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q24: Under the Parent Company Theory, which of

Q30: The focus of the Consolidated Financial Statements

Q32: Non-Controlling Interest is presented in the Shareholders'

Q38: Contingent consideration should be valued at:<br>A) the

Q43: In an inflationary economy, under which consolidation

Q46: When preparing the consolidated balance sheet on