Essay

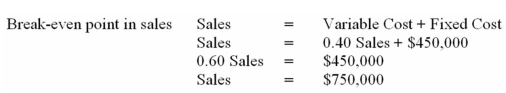

A new restaurant is ready to open for business.It is estimated that the food cost (variable cost)will be 40% of sales,while fixed cost will be $450,000.The first year's sales estimates are $1,250,000.The cost to start up this restaurant will be $2,000,000.Two financing alternatives are being considered: (a)50% equity financing and 50% debt at 12%,or (b)all equity financing.Common stock can be sold at $5 per share.

A)Compute break-even point.

B)Compute DOL.

C)Compute DFL and DCL for both financing plans.

D)Include an explanation of what your computations mean.

A)  B) C) D)Subjective.

B) C) D)Subjective.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following is not true

Q3: If the contribution margin on the firm's

Q4: In break-even analysis the contribution margin is

Q6: <span class="ql-formula" data-value="\begin{array}{lr}\text { Sales }(75,000 \text

Q7: Raw materials used in the manufacturing process

Q9: Operating Leverage works best when volume is

Q11: Operating leverage determines how income from operations

Q60: Which of the following is concerned with

Q86: Operating leverage influences the bottom half of

Q87: Operating leverage primarily affects the left-hand side