Multiple Choice

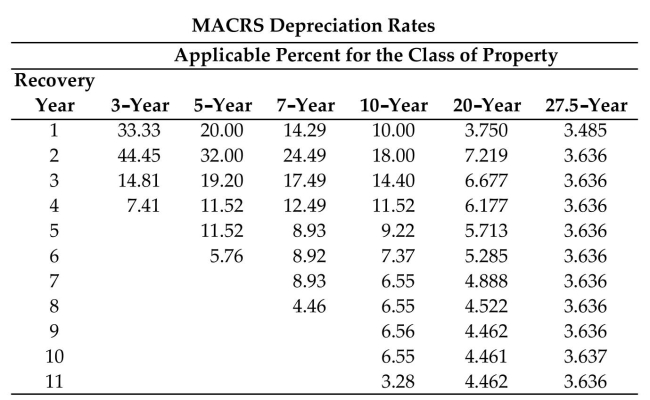

Use the MACRS depreciation rates table to find the recovery percent (rate) , given the recovery year and recovery period.

-Recovery year: 5

Recovery period: 5-year

A) 8.93%

B) 12.49%

C) 7.41%

D) 11.52%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Find the annual straight-line rate of depreciation

Q10: Use the double-declining-balance method of depreciation. Round

Q11: Provide an appropriate response.<br>-Explain in your own

Q12: Use the MACRS depreciation rates table to

Q13: Provide an appropriate response.<br>-Explain why a business

Q15: Find the book value using the MACRS

Q16: Provide an appropriate response.<br>-Explain how the annual

Q17: Find the book value using the MACRS

Q18: Find the annual amount of depreciation using

Q19: Find the book value to the nearest