Multiple Choice

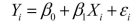

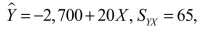

SCENARIO 13-1 A large national bank charges local companies for using their services.A bank official reported the results of a regression analysis designed to predict the bank's charges (Y) -- measured in dollars per month -- for services rendered to local companies.One independent variable used to predict service charges to a company is the company's sales revenue (X) -- measured in millions of dollars.Data for 21 companies who use the bank's services were used to fit the model:  The results of the simple linear regression are provided below.

The results of the simple linear regression are provided below.

two-tail p value =0.034 (for testing

two-tail p value =0.034 (for testing

-Referring to Scenario 13-1, interpret the p-value for testing whether  exceeds 0.

exceeds 0.

A) There is sufficient evidence (at the  = 0.05) to conclude that sales revenue (X) is a useful linear predictor of service charge (Y) .

= 0.05) to conclude that sales revenue (X) is a useful linear predictor of service charge (Y) .

B) There is insufficient evidence (at the  = 0.10) to conclude that sales revenue (X) is a useful linear predictor of service charge (Y) .

= 0.10) to conclude that sales revenue (X) is a useful linear predictor of service charge (Y) .

C) Sales revenue (X) is a poor predictor of service charge (Y) .

D) For every $1 million increase in sales revenue, you expect a service charge to increase $0.034.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: SCENARIO 13-10<br>The management of a chain electronic

Q103: SCENARIO 13-12<br>The manager of the purchasing department

Q128: SCENARIO 13-4<br>The managers of a brokerage firm

Q143: SCENARIO 13-3 The director of cooperative education

Q145: The sample correlation coefficient between X and

Q152: SCENARIO 13-9<br>It is believed that, the average

Q158: SCENARIO 13-10<br>The management of a chain electronic

Q180: SCENARIO 13-4<br>The managers of a brokerage firm

Q197: SCENARIO 13-3<br>The director of cooperative education at

Q198: The width of the prediction interval for