Short Answer

SCENARIO 13-7 An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the  500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i

500, then it is possible to reduce the variability of the portfolio's return.In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of 26 years of S&P 500 i  ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde

ndex and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 inde  x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (

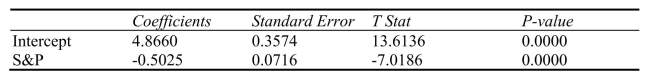

x, is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (  X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the  p-value of the associated test statistic is ______

p-value of the associated test statistic is ______

Correct Answer:

Verified

Correct Answer:

Verified

Q3: SCENARIO 13-10 The management of a chain

Q4: SCENARIO 13-10 The management of a chain

Q7: SCENARIO 13-4 The managers of a brokerage

Q9: SCENARIO 13-7 An investment specialist claims that

Q55: SCENARIO 13-13<br>In this era of tough economic

Q67: SCENARIO 13-6<br>The following Excel tables are obtained

Q113: SCENARIO 13-9<br>It is believed that, the average

Q148: SCENARIO 13-4<br>The managers of a brokerage firm

Q186: SCENARIO 13-2<br>A candy bar manufacturer is interested

Q200: SCENARIO 13-12<br>The manager of the purchasing department