Multiple Choice

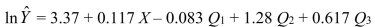

SCENARIO 16-14 A contractor developed a multiplicative time-series model to forecast the number of contracts in future quarters, using quarterly data on number of contracts during the 3-year period from 2011 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-14, in testing the coefficient of X in the regression equation (0.117) the results were a t-statistic of 9.08 and an associated p-value of 0.0000.Which of the following is the best interpretation of this result?

A) The quarterly growth rate in the number of contracts is significantly different from 0% (  = 0.05) .

= 0.05) .

B) The quarterly growth rate in the number of contracts is not significantly different from 0% (  = 0.05) .

= 0.05) .

C) The quarterly growth rate in the number of contracts is significantly different from 100% (  = 0.05) .

= 0.05) .

D) The quarterly growth rate in the number of contracts is not significantly different from 100% (  = 0.05) .

= 0.05) .

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A second-order autoregressive model for average mortgage

Q4: SCENARIO 16-12 A local store developed a

Q8: The MAD is a measure of the

Q10: The following is the list of MAD

Q19: True or False: Each forecast using the

Q119: SCENARIO 16-4<br>The number of cases of merlot

Q120: When using the exponentially weighted moving average

Q126: SCENARIO 16-13<br>Given below is the monthly time

Q133: SCENARIO 16-5<br>The number of passengers arriving at

Q164: The cyclical component of a time series<br>A)represents