Multiple Choice

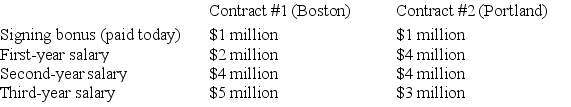

Suppose that Stephen Curry, a basketball player for the Golden State Warriors, will become a free agent at the end of this NBA season. Suppose that Curry is considering two possible contracts from different teams. Note that the salaries are paid at the end of EACH year.

The interest rate is 10%. Based on this information, which of the following is true?

A) Curry should take the Boston contract because it has a higher present value.

B) Curry should take the Portland contract because it has a higher present value.

C) Curry is indifferent between the two contracts because they are both worth $12 million.

D) Curry is indifferent between the two contracts because they are both worth $10.9 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Considering the data on real and nominal

Q28: The shorter the time until a payment

Q29: The future value of $100 at a

Q30: The rule of 72 says that at

Q31: As inflation increases, for any fixed nominal

Q33: Compute the future value of $1,000 at

Q34: The price of a coupon bond will

Q35: Doubling the future value will cause:<br>A) the

Q36: A coupon bond is a bond that:<br>A)

Q37: What is the present value of $500