Essay

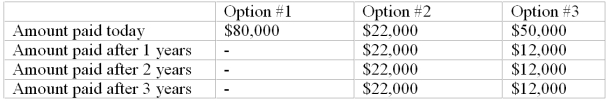

Suppose that you have a winning lottery ticket for $100,000. The State of California doesn't pay this amount up front - this is the amount you will receive over time. The State offers you two options. The first pays you $80,000 up front and that will be the entire amount. The second pays you winnings over a three year period. The last option pays you a large payment today with

small payments in the future. The payment options are detailed in the table below:

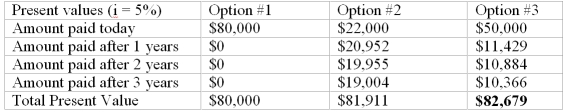

Compute the present value of each payment option, assuming the interest rate is 12%. Now, compute the present values based on an interest rate of 5%. Compare your answers, explaining why they are different when the interest rate changes. When the interest rate is 5%, the present values are as follows:

Correct Answer:

Verified

When the interest rate is 12%, the prese...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Convert each of the following basis points

Q107: Compound interest means that:<br>A) you get an

Q108: If a lender wants to earn a

Q109: Which formula below best expresses the real

Q110: Suppose Tom receives a one-year loan from

Q112: Historically, many cultural groups have outlawed usury,

Q113: Explain why the Fisher equation is not

Q114: Mary deposits funds into a CD at

Q115: Higher savings usually requires higher interest rates

Q116: Tom deposits funds in his savings account