Multiple Choice

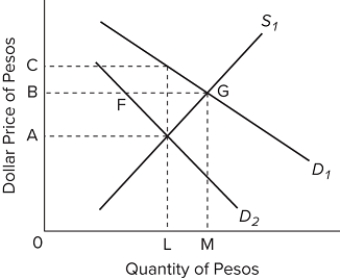

Refer to the diagram. The initial demand for and supply of pesos are shown by D₁ and S₁. Suppose the United States reduces its imports of Mexican goods, shifting its demand for pesos from D₁ to D₂. If the United States and Mexico were both on the international gold standard,

Refer to the diagram. The initial demand for and supply of pesos are shown by D₁ and S₁. Suppose the United States reduces its imports of Mexican goods, shifting its demand for pesos from D₁ to D₂. If the United States and Mexico were both on the international gold standard,

A) gold would flow from Mexico to the United States.

B) the exchange rate would rise from B dollars equals 1 peso to C dollars equals 1 peso.

C) gold would flow from the United States to Mexico.

D) the exchange rate would fall from B dollars equals 1 peso to A dollars equals 1 peso.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: U.S. businesses are demanders of foreign currencies

Q78: In 2018, the capital and financial account

Q80: Which of the following combinations is plausible,

Q83: What are two major outcomes from the

Q84: Under flexible (floating)exchange rates, if the dollar

Q85: In the U.S. balance of payments, U.S.

Q86: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table contains

Q87: If the U.S. national income grows much

Q243: The current account portion of a nation's

Q256: People will have to exchange their currency