Multiple Choice

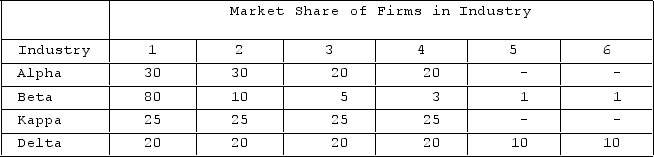

The table shows market shares of firms in hypothetical industries. Assume these are distinct industries with no buyer-seller relationships or competition among them. A merger between Firm 2 in Alpha and Firm 3 in Beta would be a

The table shows market shares of firms in hypothetical industries. Assume these are distinct industries with no buyer-seller relationships or competition among them. A merger between Firm 2 in Alpha and Firm 3 in Beta would be a

A) conglomerate merger.

B) vertical merger.

C) diagonal merger.

D) horizontal merger.

Correct Answer:

Verified

Correct Answer:

Verified

Q55: In the 1911 Standard Oil case, the

Q56: Social regulation consists of regulating the behavior

Q57: Congressional representatives have called for extensive ergonomics

Q58: A conglomerate merger is a merger between

Q59: In antitrust law, "price-fixing" refers to<br>A)the government

Q61: Interlocking directorates refers to a situation where<br>A)a

Q62: What are tying contracts? How are tying

Q63: A caption that could serve as a

Q64: In 2018, tuna companies StarKist and Bumble

Q65: A vertical merger involves a combining of