Multiple Choice

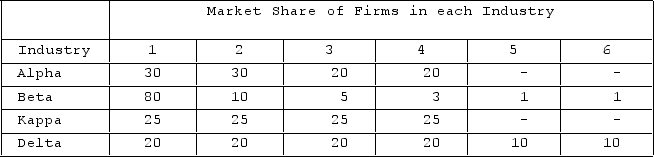

The table shows market shares of firms in hypothetical industries. Assume these are distinct industries with no buyer-seller relationships or competition among them. A merger between Firm 1 in Alpha and Firm 2 in Delta would be a

The table shows market shares of firms in hypothetical industries. Assume these are distinct industries with no buyer-seller relationships or competition among them. A merger between Firm 1 in Alpha and Firm 2 in Delta would be a

A) vertical merger.

B) horizontal merger.

C) conglomerate merger.

D) diagonal merger.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: In the U.S. Steel case of 1920,

Q38: Describe the Wheeler-Lea Act of 1938 and

Q39: Which of the following is mainly involved

Q40: What is social regulation? As a federal

Q41: The antitrust laws are enforced by the<br>A)Federal

Q43: The Americans with Disabilities Act of 1990

Q44: The Celler-Kefauver Act outlawed interlocking directorates.

Q45: The degree of strictness in the enforcement

Q46: The so-called rule of reason in interpreting

Q47: The regulation of natural monopolies has been