Multiple Choice

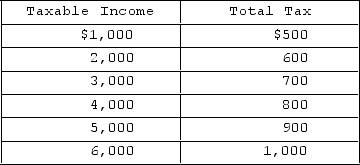

Refer to the income tax schedule given in the table. If your taxable income is $4,000, your average tax rate will be

Refer to the income tax schedule given in the table. If your taxable income is $4,000, your average tax rate will be

A) 30 percent.

B) 15 percent.

C) 10 percent.

D) 20 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Which of the following taxes is most

Q8: The incidence of taxation refers to<br>A)who in

Q9: With a tax of $4,000 on $20,000

Q10: (Advanced analysis)The equations for the demand and

Q11: Which of the following is not a

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table gives

Q14: When an excise tax or sales tax

Q15: Revenues flowing to the government from government-run

Q16: (Advanced analysis)The equations for the demand and

Q17: The interest on public debt is more