Multiple Choice

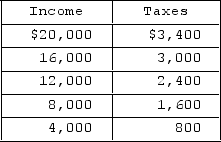

The table describes the relationship between income and a tax. The tax may be best described as

The table describes the relationship between income and a tax. The tax may be best described as

A) regressive at lower income levels and progressive at higher income levels.

B) regressive at lower income levels and proportional at higher income levels.

C) proportional at lower income levels and regressive at higher income levels.

D) proportional at lower income levels and progressive at higher income levels.

Correct Answer:

Verified

Correct Answer:

Verified

Q326: Although state and local taxes are highly

Q327: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q328: A progressive tax is such that<br>A)tax rates

Q329: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the diagram,

Q330: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table shows

Q331: The efficiency loss of a tax is

Q332: More than 50 percent of local and

Q334: The federal tax system is<br>A)proportional, while state

Q335: Transfer payments are about _ percent of

Q336: From 1960 to 2018, government purchases as