Multiple Choice

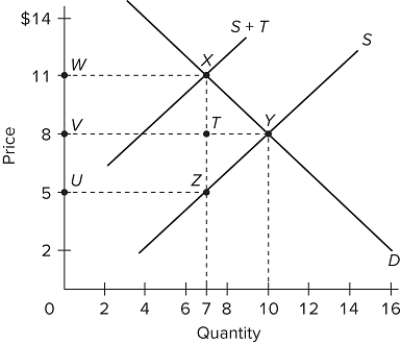

The graph illustrates the market for a product on which an excise tax has been imposed by government. What is the amount of the tax per unit of product?

The graph illustrates the market for a product on which an excise tax has been imposed by government. What is the amount of the tax per unit of product?

A) $3

B) $5

C) $6

D) $8

Correct Answer:

Verified

Correct Answer:

Verified

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The graph illustrates

Q38: In determining one's personal income tax, taxable

Q39: Given supply, the more inelastic the demand

Q40: In 2016, the top 1 percent of

Q41: The federal gasoline tax is assessed on

Q43: Tax shifting refers to the fact that<br>A)sellers

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q45: A regressive tax means that if someone

Q46: Government borrowing<br>A)is the primary means of financing

Q47: In 2018, the so-called Tax Freedom Day