Multiple Choice

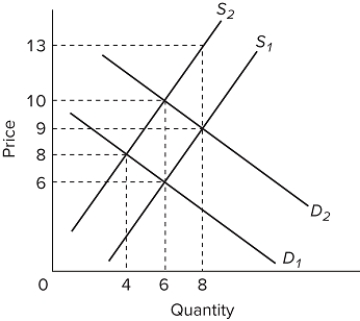

Refer to the graph. Assume the market for this product started out at the intersection of D ₂ and S ₁. Then supply shifted from S ₁ to S ₂ due to an excise tax imposed on the product. If demand subsequently shifts from D ₂ to D ₁, then which of the following will decrease?

Refer to the graph. Assume the market for this product started out at the intersection of D ₂ and S ₁. Then supply shifted from S ₁ to S ₂ due to an excise tax imposed on the product. If demand subsequently shifts from D ₂ to D ₁, then which of the following will decrease?

A) the tax per unit of the product

B) the tax revenue

C) the deadweight loss due to the tax

D) the portion of the tax per unit that is shouldered by the buyers

Correct Answer:

Verified

Correct Answer:

Verified

Q115: (Advanced analysis)The equations for the demand and

Q116: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the diagram,

Q117: Which of the following claims is not

Q118: The largest category of federal government expenditures

Q119: Just like businesses, the public sector uses

Q121: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table gives

Q122: From 1960 to 2018, government purchases in

Q123: The supply curve for a product has

Q124: The largest source of tax revenue for

Q125: Differentiate between government purchases of goods and