Multiple Choice

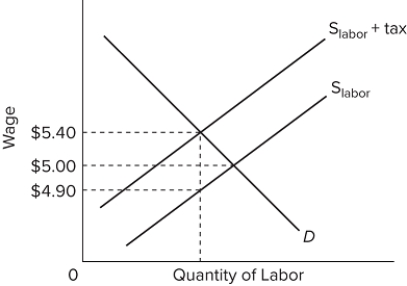

Refer to the graph for the labor market. The government decides to impose a wage tax as shown on the graph. The result is that

Refer to the graph for the labor market. The government decides to impose a wage tax as shown on the graph. The result is that

A) more workers enter the labor market due to the higher wage rate being paid.

B) the employers and laborers will split the tax evenly, each paying $0.25 to the government.

C) the wage received by laborers will rise to $5.40 and the labor cost to employers will fall to $4.90.

D) the wage received by laborers will fall to $4.90 and the labor cost to employers will rise to $5.40.

Correct Answer:

Verified

Correct Answer:

Verified

Q267: Which of the following is the largest

Q268: The marginal tax rate is<br>A)less than the

Q269: Which of the following is an exhaustive

Q270: Assume you pay a tax of $15,000

Q271: According to data compiled by the Bureau

Q273: Government purchases of goods and services are<br>A)nonexhaustive

Q274: Define proprietary income. List some examples.<br>

Q275: The largest category of federal spending is

Q276: A federal excise tax on tires for

Q277: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the diagram,