Multiple Choice

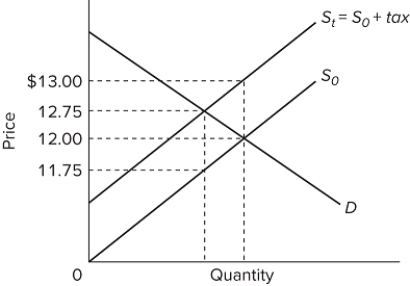

The graph shows the supply curve for a product before tax ( S ₀ ) and after an excise tax is imposed ( S ₁) . If 500 units of the product are sold after the tax is imposed, the amount of the tax borne by the consumer is

The graph shows the supply curve for a product before tax ( S ₀ ) and after an excise tax is imposed ( S ₁) . If 500 units of the product are sold after the tax is imposed, the amount of the tax borne by the consumer is

A) $125.

B) $250.

C) $375.

D) $500.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the diagram,

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table shows

Q82: The more inelastic are demand and supply,

Q83: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the diagram,

Q84: From 1960 to 2018, as percentages of

Q86: If each taxpayer paid the same lump-sum

Q87: What is a regressive tax? Explain why

Q88: If everyone pays a fixed dollar amount

Q89: A tax that takes a larger proportion

Q90: If you pay a $2,000 tax on