Multiple Choice

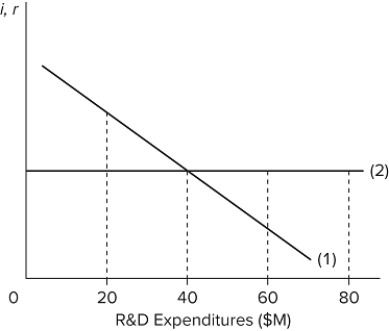

In the diagram, (1) is the

In the diagram, (1) is the

A) expected-rate-of-return curve, and (2) is the average total cost curve.

B) total revenue curve, and (2) is the interest-rate cost-of funds-curve.

C) expected-rate-of-return curve, and (2) is the interest-rate cost-of-funds curve.

D) marginal cost curve, and (2) is the marginal benefit curve.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Large, well-established firms are more likely to

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table shows

Q12: Violin strings made from sheep intestines were

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the

Q14: Explain the reasoning behind the inverted-U theory

Q16: The profit-enhancing impact of process innovation tends

Q17: According to the inverted-U theory of R&D,

Q18: The first successful commercial introduction of a

Q19: R&D spending decisions are complicated because<br>A)costs of

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table shows