Multiple Choice

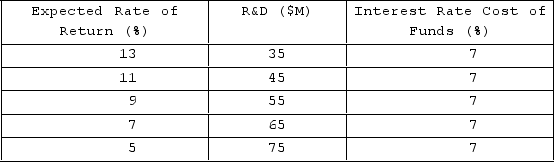

The table shows the expected rate of return, R&D spending, and interest-rate cost-of-funds for a hypothetical firm. If interest-rate cost-of-funds rose to 11, the optimal amount of R&D spending would be

The table shows the expected rate of return, R&D spending, and interest-rate cost-of-funds for a hypothetical firm. If interest-rate cost-of-funds rose to 11, the optimal amount of R&D spending would be

A) $35 million.

B) $45 million.

C) $55 million.

D) $75 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q100: Economists who contend that oligopolists have a

Q101: Consumers will make a decision to purchase

Q102: A firm should increase the amount of

Q103: Which would be a good example of

Q104: When a dominant firm quickly copies the

Q106: What is venture capital?

Q107: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The table shows

Q108: What is an example of a technological

Q109: All of the following increase the expected

Q110: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" In the graph,