Multiple Choice

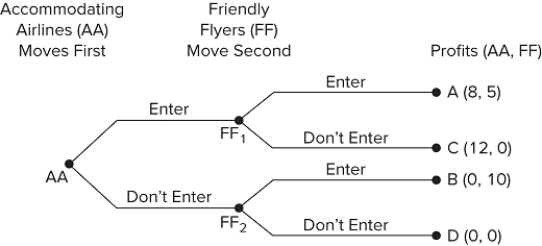

Suppose that currently there are no airlines serving the city of South Podunk. Both Accommodating Airlines and Friendly Flyers are looking to enter that market. (They are the only two.) The figure shows in extensive form the possible outcomes of the two firms' decisions. The payoffs represent, in thousands per month, the profit (or loss) the firm will realize from its decision. What does this extensive form game indicate about the decision to enter the South Podunk market?

A) Accommodating Airlines has a first-mover advantage in this game.

B) Both airlines are better off by entering this market.

C) Friendly Flyers has a first-mover advantage in this game.

D) The outcome of this game is a prisoner's dilemma.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Firms must consider the possible reaction of

Q31: Industry Y is dominated by five large

Q32: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" If enforcement of

Q33: Game trees are most useful for<br>A)showing Nash

Q34: In which market model is there mutual

Q36: The effects of advertising on a firm's

Q37: First-mover advantage cannot happen in a one-time

Q38: Price leadership represents a situation where oligopolistic

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" The diagram shows

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8602/.jpg" alt=" Refer to the