Essay

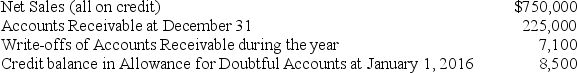

At December 31,2016,a company's records include the following:

Required:

Part a.The company estimates bad debts as 1.3% of credit sales.Prepare the required adjusting entry to record Bad Debt Expense for the year.

Part b.Assume instead that the company uses the aging of receivables method.Its aging analysis reveals that the estimate of uncollectible receivables is $11,250.Prepare the required adjusting entry to record Bad Debt Expense for the year.

Part c.Assume instead that the company estimates that its Bad Debt Expense for the year is $8,250.Use a T-account to determine the adjusted balance in the Allowance for Doubtful Accounts.

Correct Answer:

Verified

Part a

The percentage of credit sales me...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The percentage of credit sales me...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Notes receivable are typically only used when

Q46: Under the direct write-off method,the entry to

Q87: A company that uses the allowance method

Q91: Welles Company uses the direct write-off method

Q93: Starseekers,Inc.began the year with a $4,800 normal

Q111: The entry to adjust the Allowance for

Q114: Which of the following statements about the

Q126: Companies are concerned about the cost of

Q190: Although there are some clear disadvantages associated

Q234: A contra-asset account,such as Allowance for Doubtful