Multiple Choice

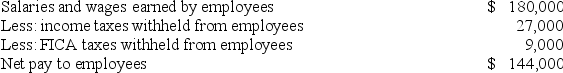

Red Mountain,Inc.has the following information from its payroll records:  The employer amount of FICA taxes that Red Mountain is required to pay is equal to the amount that it withholds from its employees.Assume no other payroll taxes are incurred at this time.What is Red Mountain's total expense with regards to this payroll?

The employer amount of FICA taxes that Red Mountain is required to pay is equal to the amount that it withholds from its employees.Assume no other payroll taxes are incurred at this time.What is Red Mountain's total expense with regards to this payroll?

A) $144,000

B) $153,000

C) $180,000

D) $189,000

Correct Answer:

Verified

Correct Answer:

Verified

Q218: Your company sells $50,000 of bonds for

Q219: A 10-year bond that pays interest annually

Q220: On October 1,2018,Teton Industries negotiates with its

Q221: FICA payments consist of Social Security taxes

Q222: Your company issues $50,000 of one-year,10% bonds

Q224: Maxwell Manufacturing issued $750,000,10-year,10% bonds at 105.

Q225: Which of the following are generally recorded

Q226: Which of the following statements about a

Q227: A one-year,$15,000,6% note is signed on April

Q228: Liabilities are classified as current if they:<br>A)will