Essay

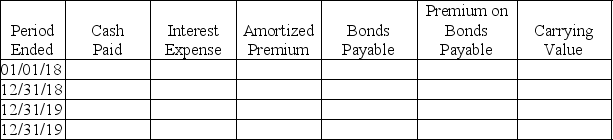

On January 1,2018,a company issues 3-year bonds with a face value of $50,000 and a stated interest rate of 7%.Because the market interest rate is 5%,the company receives $52,723 for the bonds.

Required:

Fill in the table assuming the company uses effective-interest bond amortization.

Correct Answer:

Verified

* Carryin...

* Carryin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q250: A contingent liability is:<br>A)always a specific amount.<br>B)an

Q251: On January 1,2018,a company issues 3-year bonds

Q252: A bond discount is:<br>A)a result of the

Q253: A company purchased equipment by issuing a

Q254: Burlingame Co.is purchasing a new forklift to

Q255: At the maturity date,the carrying value of

Q257: Using straight-line amortization,when a bond is sold

Q258: Payroll taxes paid by employees include which

Q259: A company receives $102,000 when it issues

Q260: Travis County Bank agrees to lend Brickyard