Essay

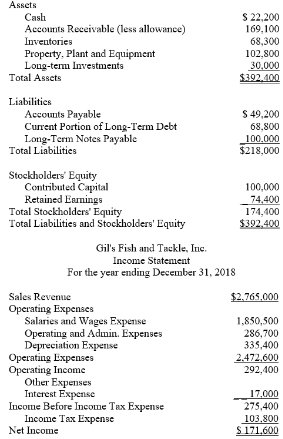

Consider the following information:

Required:

Part a.Calculate the debt-to-assets ratio.

Part b.Describe what the debt-to-assets ratio tells you and how to interpret it.

Part c.Calculate the times interest earned.

Part d.Comment on the results of your times interest earned analysis.

Correct Answer:

Verified

Part a

Debt-to-assets ratio = Total liab...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Debt-to-assets ratio = Total liab...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q199: Company A has liabilities of $6,773,000 and

Q200: A negative times interest earned ratio suggests

Q201: Maxwell Manufacturing issued $750,000,10-year,10% bonds at 105.

Q202: The straight-line method of amortization allocates the

Q203: On January 1,2018,Diana Industries issues 3-year bonds

Q205: Your company issues a 5-year bond with

Q206: Gross earnings for the pay period are

Q207: Contingent liabilities arise from past transactions,but depend

Q208: If ABC Company issues 100 of its

Q209: The stated rate:<br>A)remains the same throughout the