Essay

On January 1,2018,Trueblood,Inc.purchased a piece of machinery for use in operations.The total acquisition cost was $33,000.The machine has an estimated useful life of three years and a residual value of $3,000.Assume that units produced by the machine will total 16,000 during 2018,23,000 during 2019,and 21,000 during 2020.

Required:

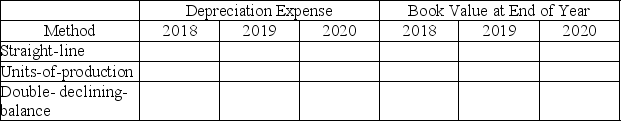

Part a.Use this information to complete the following table.

Part b.On January 1,2019,the machine was rebuilt at a cost of $7,000.After it was rebuilt,the total estimated life of the machine was increased to five years (from the original estimate of three years)and the residual value to $6,000 (from $3,000).Assume that the company chose the straight-line method for depreciation.Compute the annual depreciation expense after the change in estimates.

Part b.On January 1,2019,the machine was rebuilt at a cost of $7,000.After it was rebuilt,the total estimated life of the machine was increased to five years (from the original estimate of three years)and the residual value to $6,000 (from $3,000).Assume that the company chose the straight-line method for depreciation.Compute the annual depreciation expense after the change in estimates.

Use the information provided in Part b.to answer Part c,d,and e.

Part c.Prepare the adjusting entry to record the depreciation expense for the year ended December 31,2019.

Part d.On December 31,2020,the machine was sold for $7,500.Compute the book value on that date.

Part e.Prepare the journal entry to record the sale.

Correct Answer:

Verified

Part a

Calculations:

(1)($33,000 − $3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Calculations:

(1)($33,000 − $3...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Match each account name with the category

Q60: On January 1,2018,Lamar,Inc.purchased equipment for $250,000.It has

Q61: A company bought a piece of equipment

Q62: Morten Co. ,which uses the double-declining-balance method

Q63: A company purchased office equipment for $24,500

Q64: A machine is purchased on January 1,2018,for

Q66: Which of the following is a long-lived

Q67: Which of the following statements regarding goodwill

Q69: Company A uses an accelerated depreciation method

Q187: Match each of the following accounts with