Essay

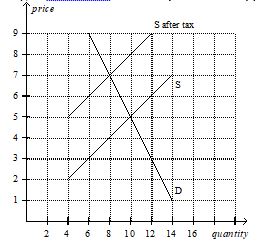

Using the graph shown,answer the following questions.

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

How much will the buyer pay for the product after the tax is imposed?

How much will the seller receive after the tax is imposed?

As a result of the tax,what has happened to the level of market activity?

Correct Answer:

Verified

a.$5

b.$3

c.$2

d.$1

e.$7

f.$4

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$3

c.$2

d.$1

e.$7

f.$4

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Under rent control,bribery is a mechanism to<br>A)bring

Q71: Suppose the government imposes a $40 tax

Q139: Which of the following causes a surplus

Q172: A tax imposed on the buyers of

Q181: Which of the following causes a shortage

Q229: A tax on buyers shifts the demand

Q277: If a price ceiling of $1.50 per

Q320: Workers, rather than firms, bear most of

Q404: Figure 6-23<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Figure 6-23

Q408: Figure 6-11<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Figure 6-11