Multiple Choice

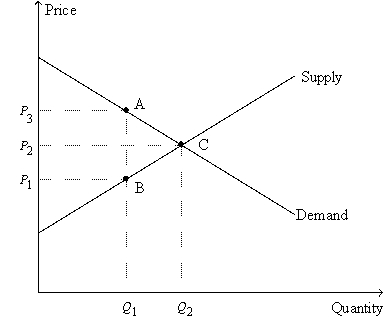

Figure 8-11

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then,when the tax is imposed,

A) consumer surplus decreases by $13.

B) producer surplus decreases by $13.

C) the deadweight loss amounts to $6.

D) the amount of the good that is sold remains unchanged.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Figure 8-2<br>The vertical distance between points A

Q29: Which of the following events is consistent

Q40: For the purpose of analyzing the gains

Q59: Suppose a tax of $0.10 per unit

Q140: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10

Q165: The most important tax in the U.S.

Q287: Scenario 8-2<br>Tom mows Stephanie's lawn for $25.

Q289: The Social Security tax is a tax

Q291: Figure 8-10<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Figure 8-10

Q293: Figure 8-12<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Figure 8-12