Multiple Choice

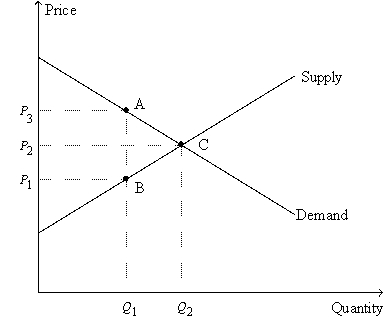

Figure 8-11

-Refer to Figure 8-11.Suppose Q₁ = 4; Q₂ = 7; P₁ = $6; P₂ = $8; and P₃ = $10.Then,when the tax is imposed,

A) the government collects $28 in tax revenue.

B) producer surplus decreases by $13.

C) consumer surplus decreases by $11.

D) the deadweight loss amounts to $9.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Taxes on labor encourage which of the

Q5: Labor taxes may distort labor markets greatly

Q44: In which of the following cases is

Q49: The marginal tax rate on labor income

Q53: Figure 8-2<br>The vertical distance between points A

Q83: When a tax is imposed on a

Q100: The loss in total surplus resulting from

Q195: The decrease in total surplus that results

Q243: Figure 8-8<br>Suppose the government imposes a $10

Q262: Figure 8-7<br>The vertical distance between points A