Multiple Choice

Table 8-1

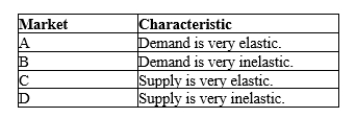

-Refer to Table 8-1. Suppose the government is considering levying a tax in one or more of the markets described in the table. Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

A) market A only

B) markets A and C only

C) markets B and D only

D) market C only

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If a tax shifts the demand curve

Q4: Taxes on labor encourage which of the

Q10: Figure 8-26 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-26

Q20: Taxes on labor tend to increase the

Q56: Assume the supply curve for diapers is

Q82: Taxes on labor tend to encourage second

Q103: A tax raises the price received by

Q115: In the market for widgets,the supply curve

Q177: Figure 8-4<br>The vertical distance between points A

Q201: Figure 8-5<br>Suppose that the government imposes a