Multiple Choice

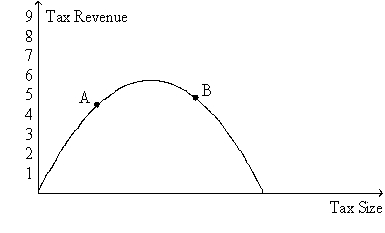

Figure 8-19. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.

-Refer to Figure 8-19.If the economy is at point A on the curve,then a decrease in the tax rate will

A) increase the deadweight loss of the tax and increase tax revenue.

B) increase the deadweight loss of the tax and decrease tax revenue.

C) decrease the deadweight loss of the tax and increase tax revenue.

D) decrease the deadweight loss of the tax and decrease tax revenue.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Taxes are of interest to<br>A)microeconomists because they

Q4: Who once said that taxes are the

Q19: Which of the following events always would

Q48: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10

Q63: Figure 8-9<br>The vertical distance between points A

Q69: When demand is relatively elastic, the deadweight

Q82: Figure 8-6<br>The vertical distance between points A

Q96: Which of the following quantities decrease in

Q215: When a tax is levied on the

Q406: Figure 8-7<br>The vertical distance between points A