Multiple Choice

Table 12-2

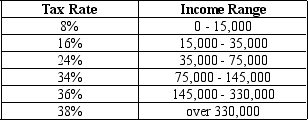

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Noah has taxable income of $43,000,his average tax rate is

A) 14.7%.

B) 16.3%.

C) 20.8%.

D) 24.0%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Table 12-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Table 12-5

Q5: Table 12-10<br>The following table shows the marginal

Q61: The two types of taxes that are

Q75: Which type of tax is used to

Q101: In addition to tax payments, the two

Q115: Horizontal and vertical equity are the two

Q125: One characteristic of an efficient tax system

Q138: Table 12-15 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-15

Q343: In choosing the form of a tax,

Q414: Suppose a country imposes a lump-sum income