Multiple Choice

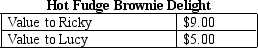

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $4.00 to $6.00.Total consumer surplus

A) falls by less than the tax revenue generated.

B) falls by more than the tax revenue generated.

C) falls by the same amount as the tax revenue generated.

D) will not fall since Jennifer will no longer be in the market.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Rank the following state and local government

Q29: In 2009,federal government receipts were approximately<br>A) $6,800

Q30: A payroll tax is also referred to

Q33: Scenario 12-3<br>Suppose that Bob places a value

Q51: Medicare is the<br>A)government's health plan for the

Q53: Which tax system requires higher-income taxpayers to

Q67: The U.S. tax burden is<br>A)about the same

Q73: A family's income tax liability is<br>A)a standard

Q101: With a lump-sum tax, the<br>A)marginal tax rate

Q205: Sue earns income of $80,000 per year.