Multiple Choice

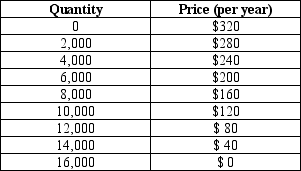

Table 17-4. The information in the table below shows the total demand for high-speed Internet subscriptions in a small urban market. Assume that each company that provides these subscriptions incurs an annual fixed cost of $200,000 (per year) and that the marginal cost of providing an additional subscription is always $80.

-Refer to Table 17-4.Assume there are two high-speed Internet service providers operating in this market.Further assume that they are not able to collude on the price and quantity of subscriptions to sell.What price will they charge for a subscription when this market reaches a Nash equilibrium?

A) $120

B) $160

C) $200

D) $240

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Scenario 17-4.<br><br>Consider two cigarette companies, PM Inc.

Q11: In 1971,Congress passed a law that banned

Q12: Table 17-5. Imagine a small town in

Q33: If all of the firms in an

Q134: In some games, the noncooperative equilibrium is

Q296: Predatory pricing refers to<br>A)a firm selling certain

Q365: Resale price maintenance involves a firm<br>A)colluding with

Q410: Table 17-8<br>For a certain small town, the

Q451: The oligopoly price will be greater than

Q521: Laurel and Janet are competitors in a