Essay

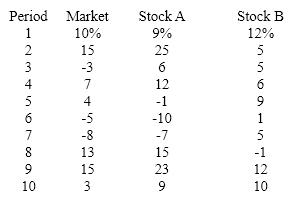

(This problem illustrates the computation of beta coefficients may be solved using a statistics program or Excel.)The returns on the market and stock A and stock B are as follows:

Compute the beta coefficient for each stock and interpret the results of the computations.

Correct Answer:

Verified

The following answers were derived using...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: For diversification to reduce risk,<br>A)the returns on

Q38: Sources of risk to an investor include<br>1.

Q39: Reinvestment rate risk refers to fluctuations in<br>A)a

Q40: A diversified portfolio requires the securities of

Q41: The numerical value of beta for the

Q42: Inflation, which is a general decline in

Q44: If the dispersion around a stock's return

Q45: By accepting more risk, the investor will

Q47: Unsystematic risk refers to factors that are

Q48: A portfolio's beta coefficient tends to be