Multiple Choice

Exhibit 19-6

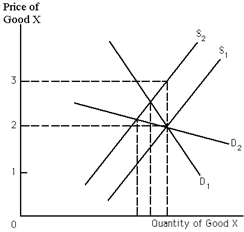

Refer to Exhibit 19-6. Let S1 be the supply curve of a producer. If S2 is the supply curve of the same producer after the government imposes a per-unit tax, the share of the tax paid by the producer as compared to the share of the tax paid by consumers will be

A) greater if D1 is the demand curve facing the producer.

B) greater if D2 is the demand curve facing the producer.

C) the same regardless of which demand curve the firm faces.

D) less if D2 is the demand curve facing the producer.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: It is very important for the seller

Q41: For a certain good, when the good's

Q83: For a normal good, _ falls as

Q102: If the price elasticity of demand for

Q131: When price = $33, quantity demanded =

Q157: An inferior good is<br>A)any good that consumers

Q159: When quantity demanded of a good increases,

Q184: Exhibit 19-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9059/.jpg" alt="Exhibit 19-3

Q185: The demand curve for good X is

Q191: The price elasticity of demand indicates<br>A)buyers' responsiveness