Multiple Choice

Figure 18-2

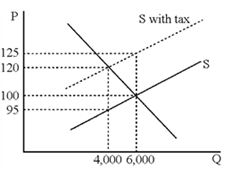

Figure 18-2 shows the widget market before and after an excise tax is imposed. What percentage of the tax per widget is borne by consumers, considering the true economic incidence of the tax?

A) 0 percent

B) 20 percent

C) 50 percent

D) 80 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: The second largest source of revenue for

Q18: The federal government receives most of its

Q85: A tax that does not change consumers'

Q87: Direct taxes are levied on specific economic

Q134: Which of the following government entities relies

Q155: Which of the following is a direct

Q162: A proportional tax is one in which

Q175: The term "fiscal federalism" refers to<br>A)deficit financing

Q176: An excise tax<br>A)is a sales tax on

Q211: Explain why some argue that income tax