Essay

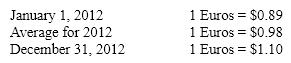

United owns Estada, a European based subsidiary for which the Euro is the functional currency. Estada had a net asset position at January 1, 2012 of 1,200,000 Euros and reported income of 350,000 Euros for 2012, which was earned evenly throughout the year. In addition, Estada paid 100,000 Euros of dividends at December 31, 2012. The following were in effect during 2012:

Determine the amount of the unrealized translation gain or loss United should record for 2012 with respect to Estada.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The term used to describe the amount

Q39: All of the following are consistent with

Q56: Record Corporation<br>CD Inc.acquires 100% of the

Q61: Which one of the following is an

Q63: U.S.GAAP stipulates that firms should _ expenditures

Q71: U.S.GAAP requires firms to expense immediately all

Q75: Firms recognize a(n)_ when the carrying amount

Q82: Currently,the FASB's Statements of Accounting Concepts (Nos.5

Q90: A company would need to record an

Q97: When a firm can exercise control or