Multiple Choice

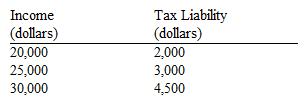

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Other things constant, how will a decrease

Q32: A subsidy is defined as<br>A) a payment

Q166: Suppose that the federal government levies a

Q216: When the top marginal tax rates were

Q239: A subsidy on a product will generate

Q298: Lowincomesville, North Carolina, is a poor town.

Q299: Use the figure below to answer the

Q301: Because illegal drug markets operate outside the

Q302: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-25

Q305: Figure 4-24 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-24