Multiple Choice

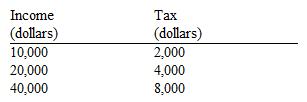

Use the table below to choose the correct answer.

The tax schedule shown here is

A) regressive.

B) proportional.

C) progressive.

D) proportional up to $20,000 and regressive beyond that.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Currently, federal and state gasoline taxes (imposed

Q2: Whenever a shortage occurs (for example, in

Q3: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-25

Q7: If a household has $40,000 in taxable

Q8: In the two decades following 1990, subsidized

Q29: The actual burden of a tax<br>A) falls

Q56: A law establishing a minimum legal price

Q199: If political officials want to minimize the

Q215: An income tax is defined as regressive

Q250: If a government price control succeeds in