Multiple Choice

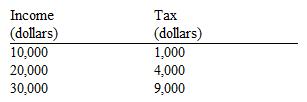

Use the table below to choose the correct answer.

For the income range illustrated, the tax shown here is

A) regressive.

B) proportional.

C) progressive.

D) regressive up to $20,000 but progressive beyond that.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: The Laffer curve illustrates the concept that<br>A)

Q41: Suppose that the minimum wage was increased

Q80: When a price ceiling prevents a higher

Q133: After a natural disaster, such as a

Q203: The term "deadweight loss" or "excess burden"

Q213: If a $300 subsidy is legally (statutorily)

Q214: An increase in the demand for a

Q218: If Neleh's income increases from $60,000 to

Q234: An excise tax levied on a product

Q254: Taxes create deadweight losses because they<br>A) reduce