Multiple Choice

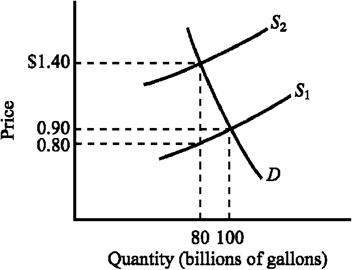

Use the figure below to answer the following question(s) .

Figure 4-7

Refer to Figure 4-7. The supply curve S 1 and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S 1 to S 2. Which of the following states the actual burden of the tax?

A) $.50 for buyers and $.10 for sellers

B) $.50 for sellers and $.10 for buyers

C) The entire $.60 falls on sellers.

D) The entire $.60 falls on buyers.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The Laffer curve illustrates the concept that<br>A)

Q88: If the government wants to raise tax

Q203: Which of the following statements about rent

Q204: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-20

Q205: The Laffer curve illustrates the principle that<br>A)

Q206: Kathy works full time during the day

Q207: Compared to legal markets, black markets have<br>A)

Q210: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-20

Q213: If a $300 subsidy is legally (statutorily)

Q254: Taxes create deadweight losses because they<br>A) reduce